Ideally when a business needs to buy something a purchase order is submitted and an approval is received before the item or service is bought. However, there are scenarios when that is not always possible. Sometimes employees are outside of the office and need to make a purchase sooner rather than later. Other times employees need to travel for work and end up racking up miles on their vehicle.

Prior to 2018 employees who made out of pocket work-related purchases and did not get reimbursed for them could deduct those costs on their tax return. However, thanks to the Tax Cuts and Jobs Act, that option is no longer available.

There is no federal law that says employers must reimburse employees for out of pocket expenses. However, some states (like California) are more favorable to employees and require that employers reimburse for necessary job expenses.

What Employers Can Do

To handle these costs efficiently many employers create an accountable plan which outlines how the employee will be reimbursed, how charges should be substantiated, how much and when they will be reimbursed. Although there is flexibility in these terms an accountable plan should require that:

- The reimbursement be a valid business expense that is in connection with the services of the employee

- Employees must provide receipts or show cause for the expenses

- Employees must return any excess money advanced that was not used for work-related expenses

How to Reimburse Employees

An employer typically reimburses employees, after the fact, for documented work-related expenses in an accountable plan. The reimbursement is not taxable to the employee.

Employers can also advance the employee money within 1 month of the anticipated activity. The employee is then expected to provide the employer with receipts and/or reports within 2 months from when the expenses were incurred. If the advance is more than the work-related expenses then the employee should return the difference. If not returned, the excess is included in the employee’s wages.

Although not required employers should outline, in a written document, the process of employee reimbursements.

If an employer does not have an accountable plan the amount reimbursed should be included in the employee’s paycheck. Even though these rates can be used documentation of the expenses should still be retained.

Per Diem Rates

The IRS publishes per diem rates that employers can use to reimburse employees for lodging and meals when traveling. The per diem amounts given to the employee are not taxable and not included in the employee’s Form W-2. The employer can pay more than what’s listed in the per diem tables but the excess is taxable to the employee.

Even if an employer pays an employee per diem rates for lodging and meal costs document of the work-related activity is still needed. An expense report must have:

- Location and date of travel

- Reason for travel

- Lodging receipts (if using meals-only per diem rate)

A Win-Win Situation

Having an accountable plan is not just for the employee or just for the employer. It can benefit both. This is particularly true if an employee earns commissions. Let’s look at an example that illustrates this.

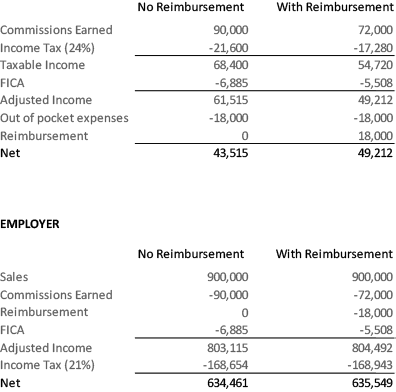

Tammy is a pharmaceutical sales rep and earns 10% commission on sales. Each year she incurs about $18,000 in out of pocket work-related expenses. Last year she brought in $900,000 in commissionable sales. If her employer reimburses her the out of pocket expenses she will end up saving about $5,697. The employer comes out ahead by hanging on to roughly $1,088.

As you can see setting up an accountable plan can be a win-win situation. The employer gets the deduction for commissions the employee gets to take advantage of out of pocket expenses that would not have been deductible otherwise.