Many taxpayers are confused about taxes and that’s understandable. With all the different credits, restrictions and changing laws taxes can be difficult to understand particularly as an S-Corp owner. Few know the advantages and disadvantages of using an S-Corp.

What is an S-Corp?

An S-Corporation is not a legal entity but an entity for tax purposes. A corporation, or an LLC, can elect to be treated as an S-Corp. This election is done by filing Form 2553 with the Internal Revenue Service. A business set up as an S-Corp has a corporate structure including corporate officers and stock. The company must be a U.S. entity and foreign persons are not allowed to be owners.

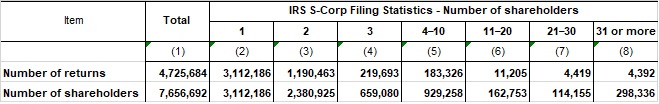

The S-Corp has become a popular entity structure because of its tax-saving benefits particularly among small business owners. In fact, a recent IRS report showed that 2 out of every 3 S-Corp tax returns filed had only one shareholder.

It is important that the S-Corp operate as a corporation by maintaining proper bookkeeping, keeping its own bank account and avoiding any commingling of personal and business funds. Many states also require that minutes be kept documenting major decisions within the S-Corp.

Advantages of an S-Corp

The biggest advantage of setting up an S-Corp is tax savings. We come across many business owners who end up spending thousands of dollars in taxes unnecessarily. What’s worse is that they do this every year!

Here are some benefits of the S-Corp:

- Payroll Tax Savings

- Pass-Through Taxation

- Perpetual Existence

- Transfer of Ownership

Disadvantages of an S-Corp

Although there are some advantages to setting up your your business as an S-Corp there are also some disadvantages you must be aware of. They include :

- Available to U.S. persons and resident aliens

- No more than 100 shareholders allowed

- Limited to one class of stock

- Higher tax preparation fee

How Is an S-Corp Taxed?

When a regular corporation, or C-Corp, is formed its shareholders pay tax on their share of profits and again when the corporation pays its own tax. The S-Corp has an advantage in this area in that it’s shareholders are the only ones who pay tax on the business income. No tax is paid at the corporate level. The S-Corp shareholders receive a Schedule K-1 for their share of the corporation’s profits and include that income on their individual tax return.

Here is an example of how this pass-through taxation works in an S-Corporation:

Bizzy decides to branch out and start his own landscaping business. Under the guidance of his accountant he decides to form an LLC and elect to have it taxed as an S-Corp. The net profit of the S-Corp is $100,000. From that Bizzy takes a salary of $40,000 and pays $6,120 in payroll tax. (Payroll tax is Social Security and Medicare and is paid at a rate of 15.3% of salary.) The remaining $60,000 is passed through the S-Corp and flows through to Bizzy’s personal tax return where he pays income tax. Had Bizzy not elected for his business to be treated as an S-Corp he would have paid $15,300 in Social Security and Medicare ($100,000 x 15.3%}.

S-Corp Reasonable Salary

As you can see the potential savings in setting up an S-Corp for your business can be significant. However, you must keep in mind that the officer working in the business must pay himself or herself a salary from the distributed profits.

The salary must be paid through payroll and related payroll tax returns must be filed. Not only must the salary be paid but it must be reasonable. Failure to draw a reasonable salary could lead the IRS to reclassify distributions and hold you liable for unpaid payroll taxes and penalties. There is no hard and fast rule as to how much is reasonable but the individual should be compensated fairly for their work performed. The IRS, however, looks at the following criteria when determining whether a salary is reasonable:

- Training and experience

- Duties and responsibilities

- Time and effort devoted to the business

- Dividend history

- Payments to non-shareholder employees

- Timing and manner of paying bonuses to key people

- What comparable businesses pay for similar services

- Compensation agreements

- The use of a formula to determine compensation

When to Elect S-Corp

Many business owners struggle with the question of when to become an S-Corp. One of the main considerations is having enough profit in the business. Without the necessary profit expenses such as increased tax return preparation fees, payroll and bookkeeping could eat into any savings from the S-Corp election.

If you are contemplating forming an S-Corp for your business feel free to contact us. We have helped many small business owners file the necessary paperwork and take advantage of the many benefits an S-Corp has to offer.