NOTE: This is for informational purposes only. Tax situations vary. If you need further assistance contact your tax professional or give us a call.

We have written several articles on the benefits of an S-corp. Perhaps the most appealing is that an S-corp could potentially save its shareholders thousands of dollars in taxes ever year.

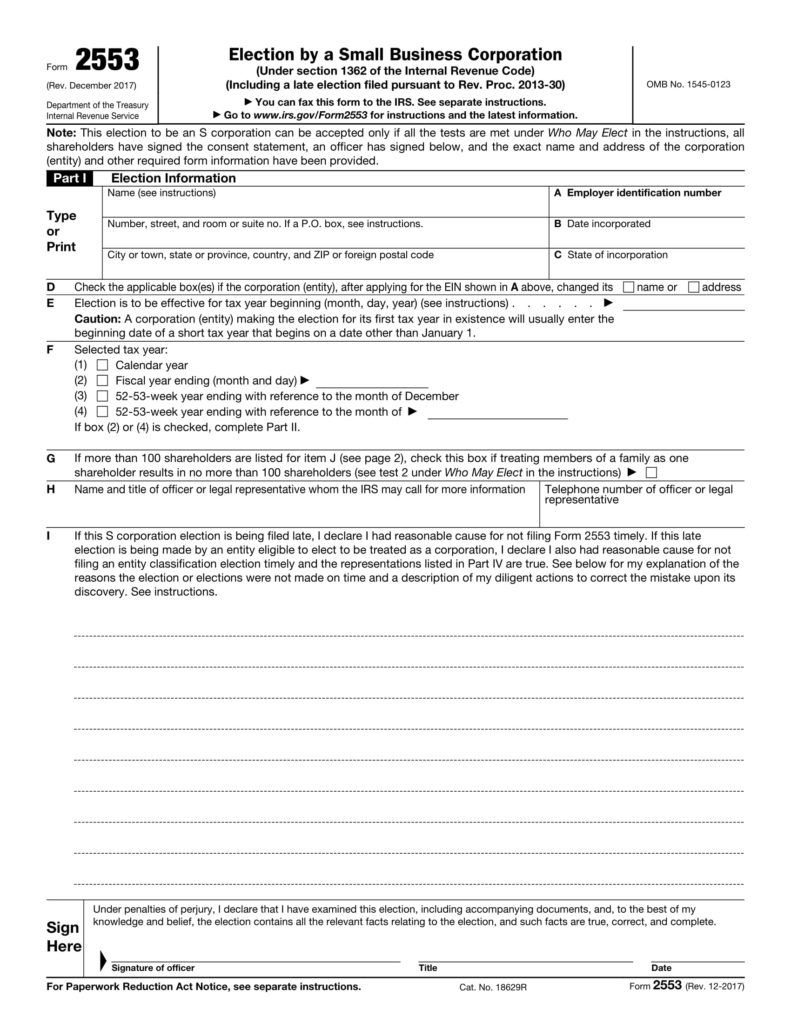

An S-corp is not a legal entity. You cannot go to your local town clerk or Secretary of State and set up your business as an S-corp. Instead you must request that your business be treated as an S-corp by filling out a form. The federal document that must be sent to the IRS to become an S-corp is Form 2553. Once you fill out and submit Form 2553 the IRS will send you an acceptance letter if your election request is granted.

Here’s how you fill out Form 2553:

PART 1

Address

The business address should match the address used when the business applied for its employer identification number (EIN).

Line A

The EIN of the business. If the business does not currently have an EIN you can apply for one using Form SS-4.

Line B

Date Incorporated

Line C

State of incorporation

Line D

If, after filing Form SS-4, the business name or addressed changed check the appropriate box.

Line E

The effective date of the S-corp election. Some businesses already in existence will enter January 1 of the following year. If the business is just getting started the date entered typically would be either the date the entity began doing business, the date it first had assets or the first date there were shareholders, whichever is earliest.

Line F

An S-corp typically has a calendar year for its required tax year. There are some instances where an S-corp can adopt a fiscal tax year or a year-end other than December 31. This is an option when a majority shareholder(s) has a fiscal year or some other business purpose warrants it. However, most S-corps use a calendar year tax year.

Line G

S-corps are limited to 100 shareholders who need to be listed on Form 2553 with spouses and certain family members considered as 1 shareholder. If more than 100 shareholders are listed but the family connection brings the total number of shareholders to 100 or less, check the box.

Line H

List the name and title of the S-corp officer that the IRS may contact. If there is just one owner/shareholder of the S-corp the person may use ‘President’ as their title.

Line I

A timely filed Form 2553 must be submitted:

- No more than 2 months and 15 days after the beginning of the year the election is to take effect OR

- At any time during the tax year preceding the tax year it is to take effect

If Form 2553 is filed late it is still possible to receive S-corp status provided there is reasonable cause. Your reasonable cause statement is made under the following claim:

1) The requesting entity is an eligible entity as defined in Regulations section 301.7701-3(a);

2) The requesting entity intended to be classified as a corporation as of the effective date of the S corporation status;

3) The requesting entity fails to qualify as a corporation solely because Form 8832, Entity Classification Election, was not timely filed under Regulations section 301.7701-3(c)(1)(i), or Form 8832 was not deemed to have been filed under Regulations section 301.7701-3(c)(1)(v)(C);

4) The requesting entity fails to qualify as an S corporation on the effective date of the S corporation status solely because the S corporation election was not timely filed pursuant to section 1362(b); and

5a) The requesting entity timely filed all required federal tax returns and information returns consistent with its requested classification as an S corporation for all of the years the entity intended to be an S corporation and no inconsistent tax or information returns have been filed by or with respect to the entity during any of the tax years, or

5b) The requesting entity has not filed a federal tax or information return for the first year in which the election was intended to be effective because the due date has not passed for that year’s federal tax or information return.

Don’t forget to sign and date page 1 of Form 2553. The business name and EIN should be entered at the top of each page before submitting your Form 2553.