If you’re like most sellers who are busy sourcing, packing and shipping products taxes are the last thing on your mind. However, when you consider the many taxes that we pay: federal income tax, state income tax, payroll tax, use tax, franchise tax, etc. it should come as no surprise that almost 50% of what you make could end up going to the government. With careful planning though you can keep more of your hard-earned money in your pocket.

An online business is like any business. Whether you sell on Amazon, Ebay, Shopify, Mercari, Poshmark or some other platform it takes time, persistence and hard work to be successful. There are also distinct responsibilities you must be aware of that a business owner has that an employee does not.

As an employee federal and state taxes are withheld from each paycheck by your employer. When it comes time to file your taxes hopefully you had enough withheld in the previous year. If too much was withheld you’ll get a refund. If too little was withheld then you’ll need to make a payment.

On the other hand, if you’re self-employed there is no employer to withhold the taxes for you. Instead the responsibility is on you to estimate how much your tax should be and pay that in quarterly installments. This is one reason why you should have up-to-date bookkeeping for your online business.

In addition to federal and state taxes your employer typically withholds FICA (for Social Security and Medicare) as well. Medicare is 2.9% of your earnings while Social Security is 12.4% (up to a certain income limit). An employer will split the cost with an employee. However, when you are self-employed guess who must pay the entire amount of Social Security and Medicare (through self-employment taxes). That’s right. You! An online seller will have to pay 15.3% of his or her net income towards this.

However, if you make enough money in your business you can incorporate (or elect to be taxed as an S-corporation) claim a reasonable salary and save a significant amount in taxes. This is possible even if your business is a LLC.

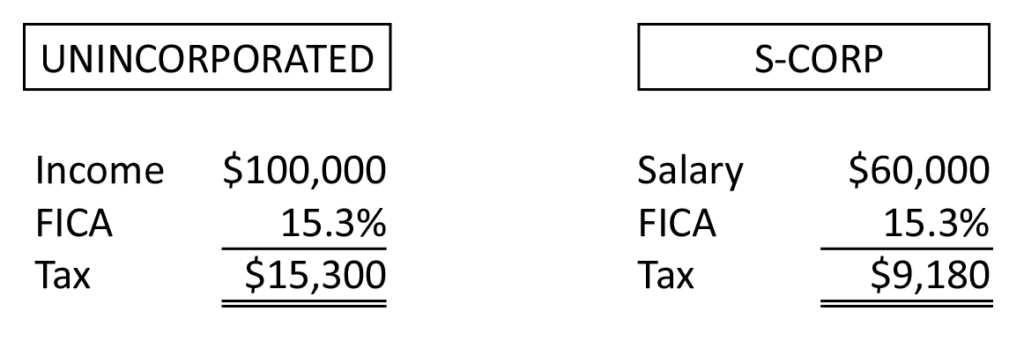

Here is an example:

Let’s say you worked hard, worked smart (or both) and you just killed it last year. Your Amazon FBA orders were shipping out of the warehouse like hotcakes, your eBay listings were flying off the shelves and you earned $100,000. You would end up paying $15,300 in self-employment taxes. However, if you claimed a reasonable salary of $60,000 you could save $6,120 in taxes. You would have to pay yourself from the S-corp and file related payroll tax returns but you can see the opportunity.

(Note: This example is for illustration purposes only. Your situation may differ and may lead to a different outcome.)

This strategy won’t work for you if you’re only selling part-time or if you’re only making a few bucks a year. However, if you’re selling on Amazon, eBay, Shopify, Mercari, Poshmark, your own website, or any other online platform, and your business is thriving you definitely want to speak with a tax professional and consider structuring your business as a corporation.

No discussion of an entity structure should be had without discussing the its pros and cons. Here are some key points you should consider.

Advantages of the S Corp

- Avoids Double Taxation

- Protects Personal Assets

- Increases Retirement/Tax Planning Options

- Payroll Tax Savings

Disadvantages of the S Corp

- Shareholders must be U.S. citizens or residents

- Profits/Losses must be in proportion to owner’s interest

- Limited to a maximum of 100 shareholders

- Only one class of stock allowed

- Additional administration/fees

The advantages of setting up your business as an S corporation far outweighs the benefits and the tax savings can be significant. If you do not have a tax professional to structure your business properly give us a call and we would be happy to help you get on the right track.