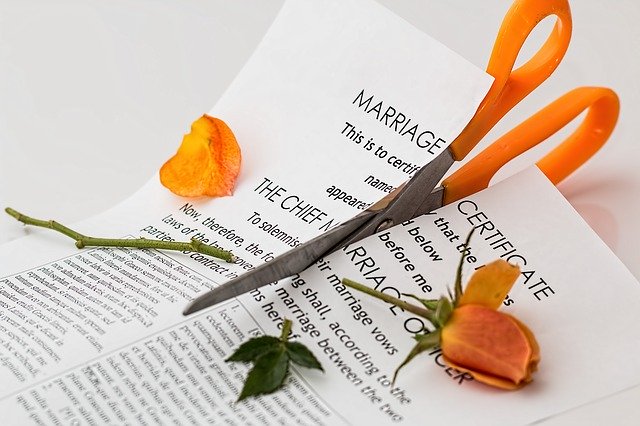

Some marriages last a lifetime. Others don’t. Whether amicable or contentious a divorce can have legal and tax consequences.

Alimony is financial support that is paid to a former spouse. If your ex earns significantly less than you there is a chance that the courts could award him or her alimony.

In divorce settlements a court order might include child support but to be considered alimony the following are required:

- The payments must be made on behalf of a spouse or former spouse

- The payments must be in cash or cash equivalent

- The payments are made after a completed divorce or legal separation

- Financial support must end when the former partner dies

- The person making the payments must not file a joint return with the former partner

The Tax Cuts and Jobs Act made alimony tax-free to the recipient and took away the deduction for the person making payments. This change applies to divorces and legal separations executed under court after 2018.

If you are planning to divorce knowing the current tax rules before your case is settled can be in your favor.